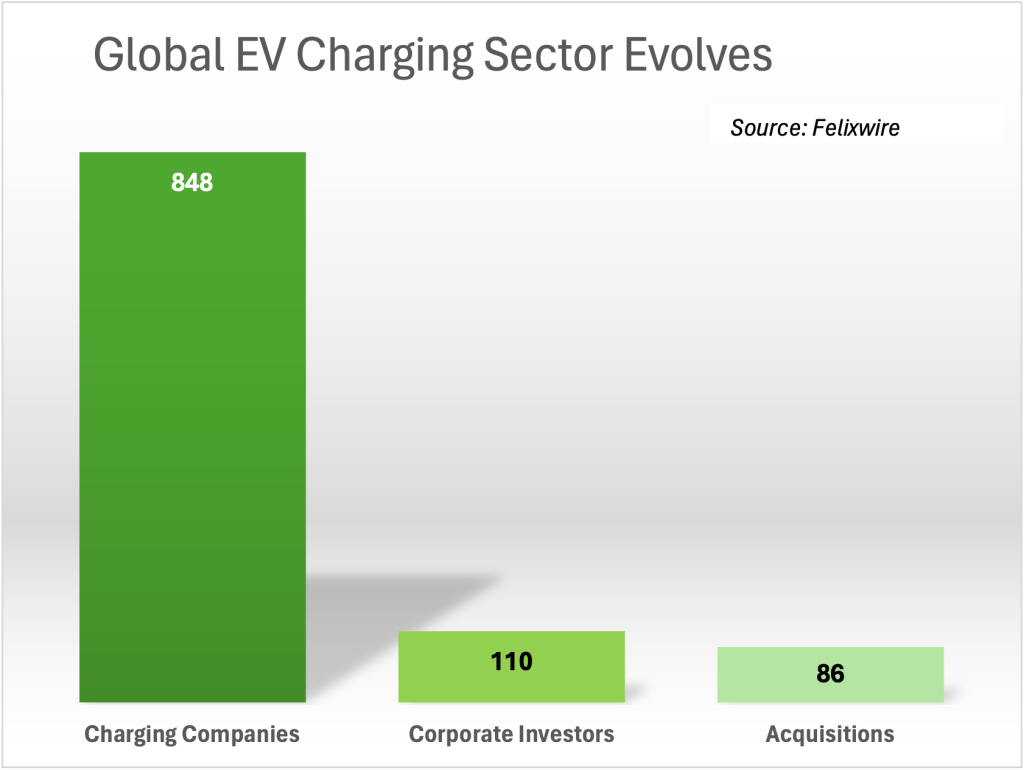

My Felixwire database is currently tracking nearly 900 electric vehicle charging companies around the globe. So what’s going on below the surface? Let’s take a deeper dive.

Felixwire, which was born in 2010, is a proprietary database of more than 7,000 companies in the sustainable transportation ecosystem. I use it to analyze patterns and trends in clean mobility to help clients identify opportunities for investment, partnerships and more.

It should come as no surprise that the two largest groups of corporate investors in charging startups are Big Auto and Big Oil. Industrial, energy and technology giants also have significant investments.

The extent of those investments, and the key players, are interesting.

- BMW and its corporate venture arm, BMW iVentures, have funded at least seven charging startups

- BP and BP Ventures have put money into six charging companies and BP has acquired two — Chargemaster and Amply Power

- Shell has hoovered up five charging startups and its Shell Ventures has invested in three more

- ABB Technology Ventures has backed six charging startups and parent ABB has acquired three more

- Microsoft, Google and eBay all have put money into charging startups

Hand in hand with these corporate investments is a broader trend toward consolidation in the sector. According to Felixwire data, at least 10% of EV charging startups — nearly 90 companies — have been acquired over the past five years.

Over the next 5-6 years, you can expect to see several broad trends in this sector:

- The buildout of charging infrastructure, especially in the United States, will accelerate

- Corporate investors will take an increasingly larger stake

- The largest charging companies will become profitable, some fed by generous government incentives

One final observation from Felixwire: Big Chinese companies will help fuel growth in the charging sector through 2030. Already we’ve seen investments from Chinese automakers (SAIC, BAIC, Changan) and tech companies (Tencent, Xiaomi) as well as battery materials firm Ganfeng Lithium.

China has already figured this out, but one key to driving future EV demand is to build out charging infrastructure, which in turn will help speed the development and deployment of smaller battery packs and reduce the price of electric vehicles.

Corporate investors, especially from China, will continue to drive that buildout.

Leave a comment